richmond property tax calculator

Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. Formulating real estate tax rates and conducting appraisals.

Www 2022 Notice Of Property Tax Increase

Property Tax Calculator Toronto has lowest property tax bil Loss of farm status could see huge tax increases Best And Worst Cities For Property Taxes Canada.

. All are official governing bodies managed by elected or appointed officials. Tax Sales Next Tax Sale is scheduled for Tuesday September 1st 2022. Unsure Of The Value Of Your Property.

View more information about payment responsibility. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion. 3 Road Richmond British Columbia V6Y 2C1 Hours.

Actual property tax assessments depend on a number of variables. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Richmond Hill has partnered with Paymentus Corporation a third-party service provider to bring you the convenience of paying your property tax online with your Visa or Mastercard. Object Moved This document may be found here. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000.

The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. Richmond Hill Property Tax 2021 Calculator u0026 Rates. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456.

New to Richmond County. Municipal Finance Authority 250-383-1181 Victoria Property Assessments. The propertys Parcel ID should be entered such as W0210213002.

Property taxes are calculated based on the assessment values set by BC Assessment. Property value 100000. Please note that we can only estimate your property tax based on median property taxes in your area.

If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. Ad Enter Any Address Receive a Comprehensive Property Report. Under the state Code reexaminations must occur at least once within a three-year timeframe.

For all who owned property on January 1 even if the property has been sold a tax bill will still be sent. For example entering W0210213 will display the. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County.

It is one of the most populous cities in Virginia. Monday - Friday 8am - 5pm. Actual property tax assessments depend on a number of variables.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. The citys average effective property tax rate is 111 among the 20 highest in Virginia. 815 am to 500 pm Monday to Friday.

The average effective property tax rate in Chesapeake an independent city in southeast Virginia is 096. 295 with a minimum of 100. These documents are provided in Adobe Acrobat PDF format for printing.

1000 x 120 tax rate 1200 real estate tax. The City Assessor determines the FMV of over 70000 real property parcels each year. Richmond Hill real estate prices have increased by 15 from November 2019 to November 2020 and the average price of a home in Richmond Hill is 12M.

Property Value 100 1000. See Results in Minutes. By Richmond City Council.

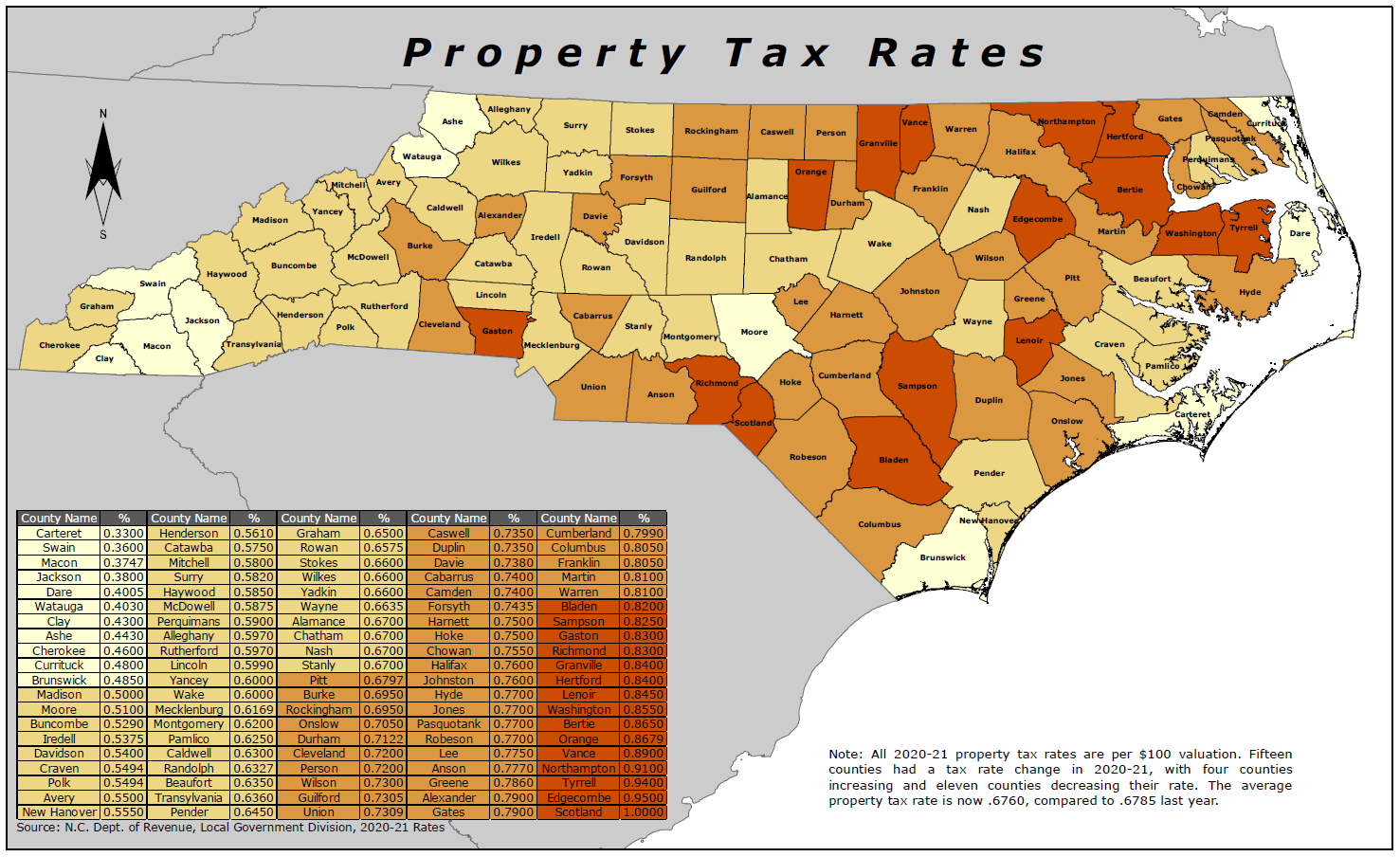

North Carolina is ranked 1986th of the 3143 counties in the United States in order of the median amount of property taxes collected. The median property tax on a 9930000 house is 104265 in the United States. Richmond County collects on average 103 of a propertys assessed fair market value as property tax.

Website Design by Granicus - Connecting People and Government. This property tax calculator is intended for approximation purposes only. A 10 yearly tax hike is the maximum raise allowed on the capped properties.

Single-family detached houses are by far the most commonly sold property type on the Richmond Hill real estate market accounting. Find All The Record Information You Need Here. To get your exact property tax liabilities contact the Richmond County Tax Assessor.

The population of Richmond Hill increased by 5 from 2011 to 2016. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Real Estate and Personal Property Taxes Online Payment.

If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access Richmond Hill at 905-771-8949. Richmond property tax calculator. Along with collections property taxation involves two additional general steps.

August 7 2021 adnecasino No comments. Usually new assessments use an en masse strategy applied to all alike property in the same locality without individual property tours. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Search by Parcel IDMap Reference Number. Broad Street Richmond VA 23219. Discover Helpful Information And Resources On Taxes From AARP.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established. Personal Property Taxes are billed once a year with a December 5 th due date. Search by Property Address Search property based on street address.

Taxing units include Richmond county governments and many special districts eg. Electronic Check ACHEFT 095. The following video provides a simplified explanation of the relationship between your assessment value and your property taxes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County. Property Taxes Due 2021 property tax bills were due as of November 15 2021. Kentucky Property Tax Calculator.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. City of Richmond Parcel Tax Search.

Real Estate Capital Gains Taxes When Selling A Home Including Rates Capital Gain Real Estate Articles Sale House

Business Broker Business Advisory Services Richmond Dc Tips For Organizing Your Company S Bi Retirement Calculator Personal Finance Bloggers Investing

New York Buyer Picks Up Northside Apartments Richmond Bizsense Apartment Projects Local Real Estate Commercial Real Estate

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province

Rental Property Management Spreadsheet Template

Average Residential Tax Bill Amount

Property Tax Appeal Tips To Reduce Your Property Tax Bill

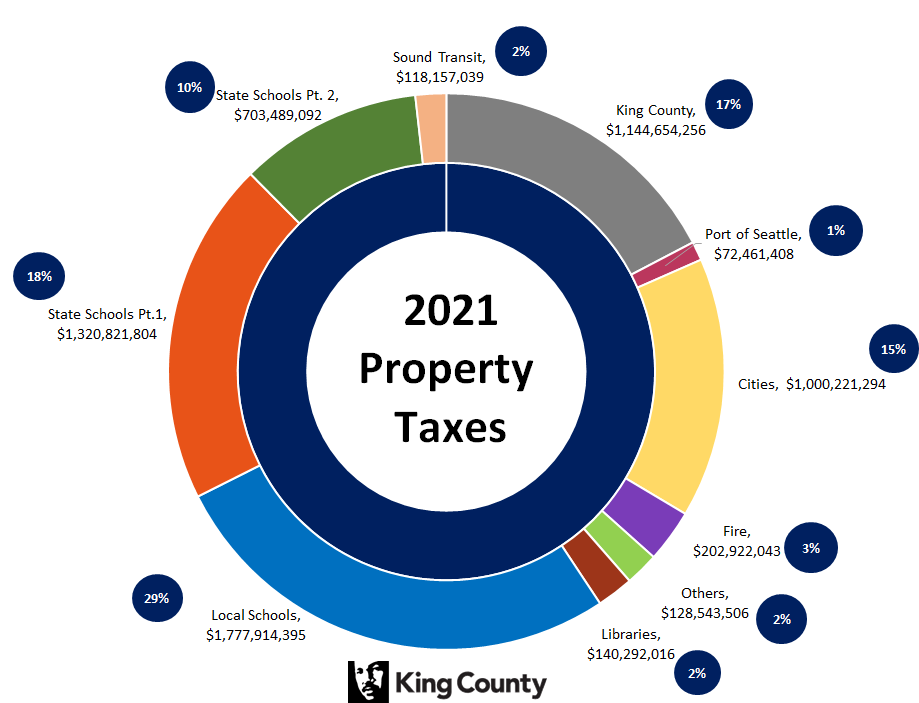

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Cash Flow Analysis Worksheet For Rental Property Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

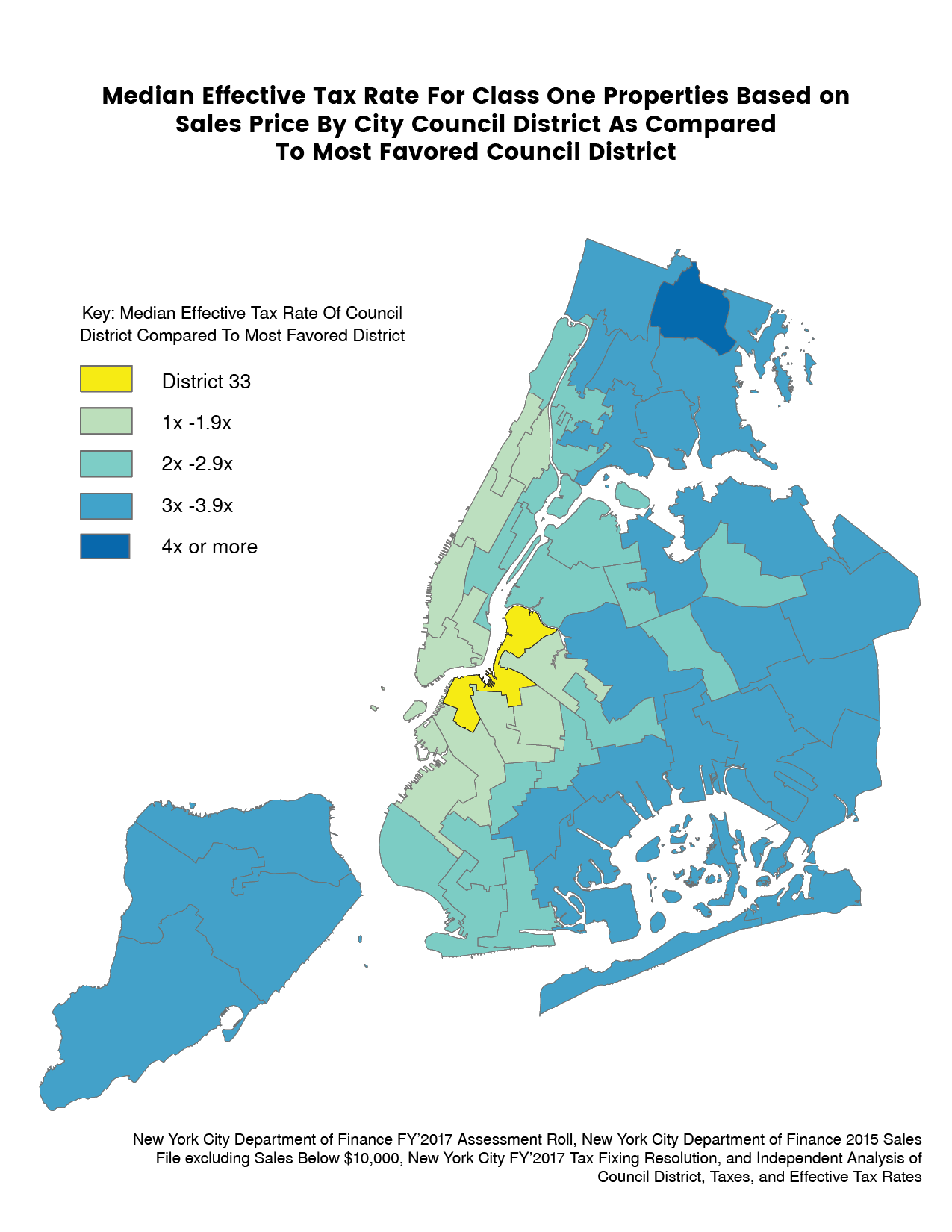

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

The Annual Property Operating Data Apod Why Real Estate Investors Use It And How To Construct

Property Tax Calculation Youtube

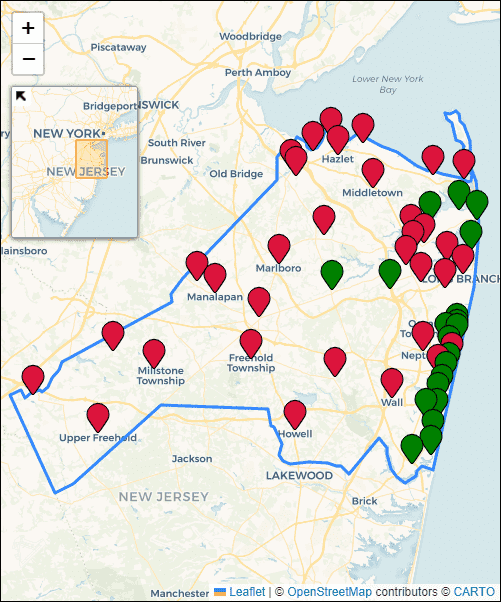

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

/cloudfront-us-east-1.images.arcpublishing.com/gray/N4FEBBFVYZAADF6KTTXLODR34U.PNG)

Myrtle Beach Property Taxes Set To Increase As Part Of 292 Million Proposed Budget